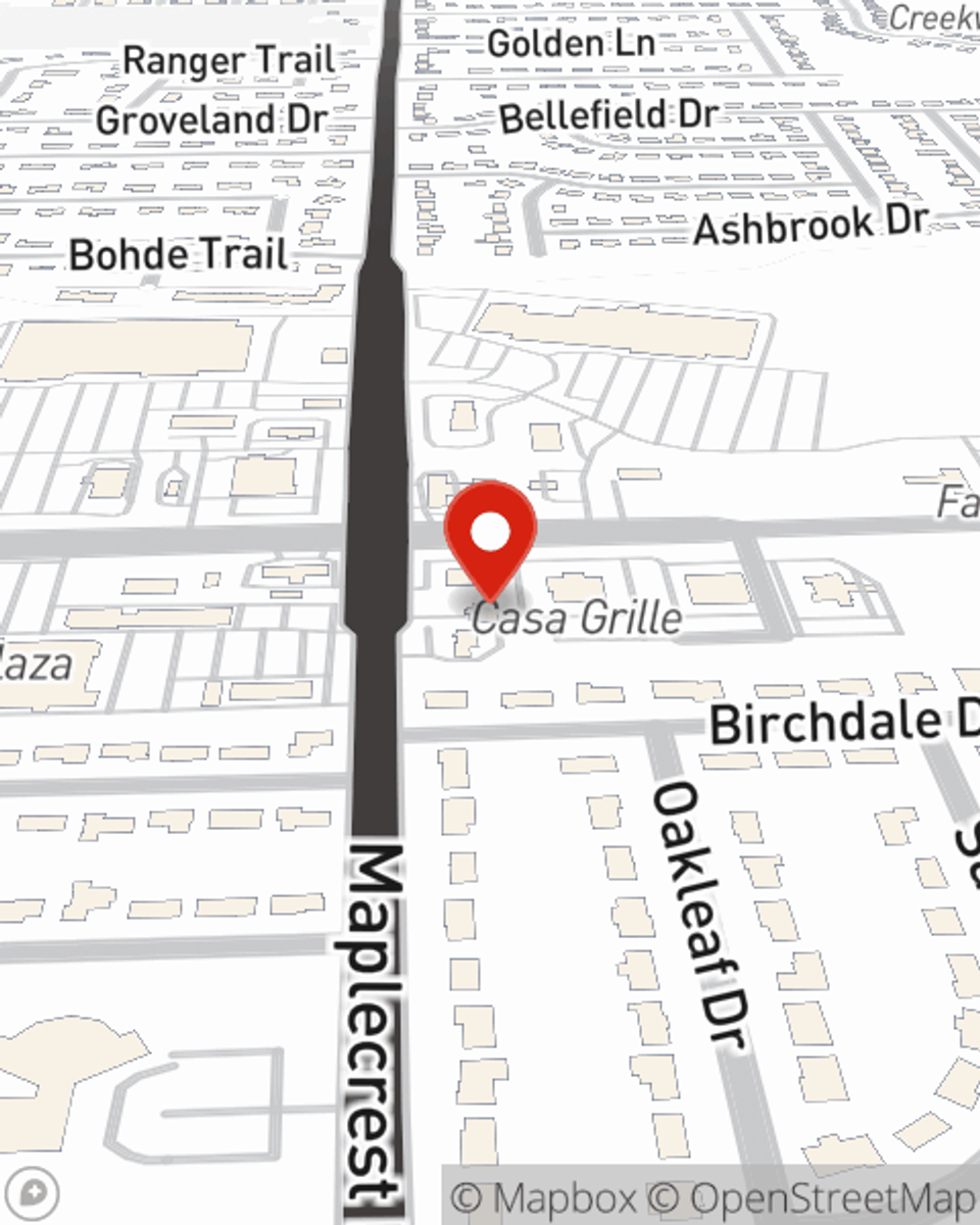

Auto Insurance in and around Fort Wayne

Looking for great auto insurance around the Fort Wayne area?

Time to get a move on, safely.

Would you like to create a personalized auto quote?

- Fort Wayne

- Leo

- Huntertown

- Woodburn

- New Haven

- Allen County

- Auburn

- Garrett

- Muncie

- Angola

- Fremont

- Sturgis, MI

- Archbold, OH

- Bryan, OH

- Swanton, OH

- Montpelier, OH

- Defiance, OH

- Hicksville, OH

- Napoleon, OH

- Three Rivers, MI

- Bronson, MI

- White Pigeon, MI

- La Grange, IN

- Howe, IN

Your Auto Insurance Search Is Over

When it comes to economical car insurance, you have plenty of choices. Sorting through deductibles, savings options, coverage options… it’s a lot, to say the least.

Looking for great auto insurance around the Fort Wayne area?

Time to get a move on, safely.

Coverage From Here To There And Everywhere In Between

With State Farm, you won’t have to sort it out alone. Your State Farm Agent Jon Till can help you understand your coverage options. You'll get the reliable auto insurance coverage you need.

This can include coverage for a variety of situations and vehicles, too, like antique or classic cars, rental car coverage or teen driver coverage. And the benefits of State Farm don't stop there! When hazards get in your way, you can be sure to receive straightforward attentive care from State Farm agent Jon Till. Contact Jon Till's office today!

Have More Questions About Auto Insurance?

Call Jon at (260) 486-4711 or visit our FAQ page.

Simple Insights®

Night driving and headlight glare

Night driving and headlight glare

Blinding headlight glare is a dangerous aspect of night driving. Read on to discover tips on how to avoid the glare from oncoming headlights and get home safely.

Signs of brake failure and what to know

Signs of brake failure and what to know

Brake safety should be every driver's concern when it comes to maintenance. Look for these potential red flags to help you keep brake failure to a minimum.

Simple Insights®

Night driving and headlight glare

Night driving and headlight glare

Blinding headlight glare is a dangerous aspect of night driving. Read on to discover tips on how to avoid the glare from oncoming headlights and get home safely.

Signs of brake failure and what to know

Signs of brake failure and what to know

Brake safety should be every driver's concern when it comes to maintenance. Look for these potential red flags to help you keep brake failure to a minimum.